COVID-19. Russia’s invasion of Ukraine. Extreme weather. The past three years have hit maritime hard, with each subsequent crisis laying bare how disjointed global seabound value chains really are.

Meghna Ray

Published on 15th Feb 2023

4 minutes read

The ongoing supply chain crisis isn’t a recent phenomenon. It’s a symptom of a deeper sickness finally coming to a head - of systemic issues that industry observers have long railed against.

Chief among the maritime industry’s maladies: data continues to be siloed across the value chain, and players struggle to operate efficiently.

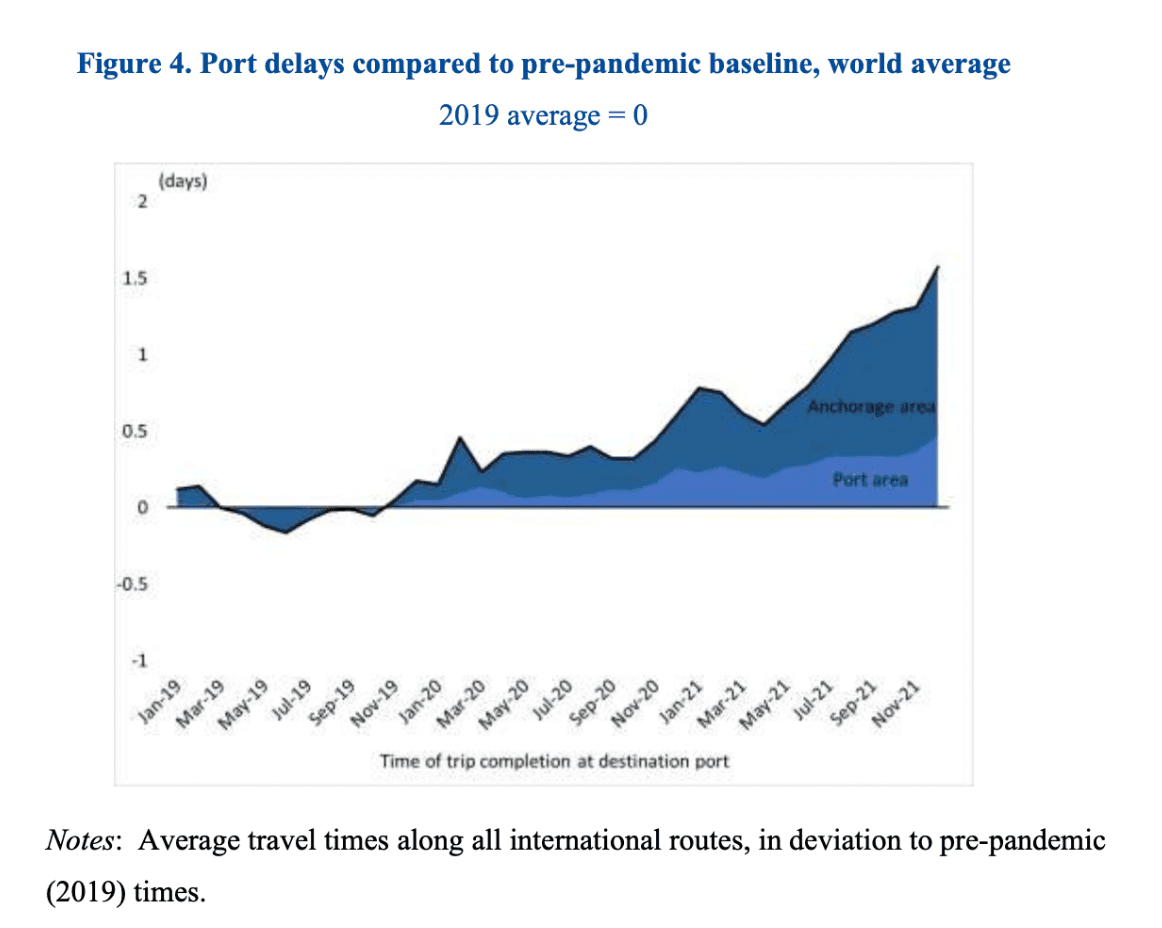

The lack of data sharing has resulted in maritime players navigating troubled waters without a clear north star. Ports, for example, saw prolonged wait times and worsened congestion despite a drop in cargo volumes in mid-2021.

GRAPH SOURCE: IMF

GRAPH SOURCE: IMF

Maritime has highly decentralised roots, but its future lies in a highly connected ecosystem. Bridging value chains via platform integrations can be the answer.

The crisis in the last three years of unmanageable, unpredictable, and unbudgeted costs, drive home the importance of a more interconnected maritime sector. It’s part of the industry’s natural evolution, and industry pioneers who get on board will be first to solve efficiency leakages.

In a dynamic world filled with uncertainties and rapidly changing conditions, connected data is the key to making sense of a messy situation and enables easier decision-making that focuses on key factors.

Platform integrations give maritime players a fuller picture of a ship’s voyage and operations by centralizing data from a variety of sources.

Greywing currently connects 10 different companies with at least twice as many data sources - each data source offering an additional dimension of empowerment.

When maritime players share critical data with key customers and suppliers, they also enhance their resilience against shocks since new insights are rapidly incorporated into overall decision-making.

By enabling further transparency of real information, platform integrations minimise wastage and make closer to accurate predictions.

Take Greywing’s integration with Dataloy System’s voyage management data feeds.

While disparate platforms could yield similar benefits with some degree of manual effort, the streamlined data from the integration not only automatically consolidates insights, but also magnifies their impact.

Alone, Greywing promises crew change efficiency. But together with Dataloy, users can effect crew changes that are cheaper, quicker, and also lower in emissions.

The virtues of real-world data aggregation aren’t lost on other maritime players. In fact, a global push towards leveling data discrepancies may already be taking shape.

The Smart Maritime Council, for one, launched a standardized vessel dataset earlier this month. A follow-up to a successful proof-of-concept by shipping lines OSM Maritime, Thome Group, and V.Ships, it promises to make data collection and analysis easier for any maritime player.

Platform integrations also free up limited resources by automating recurring processes. That frees up the crew to handle more important tasks, and cuts the search for skilled maritime labour shorter. Seafarers end up being the end benefactor of these improvements and firms see better crew retention as a result of welfare improvements.

A key reason why few shipping software firms exist is that the bulk of information in maritime is still manually entered, and largely maintained on an honour system.

Such a system naturally gives rise to inconsistencies in data input. Noon reports, a critical document that’s exchanged daily, are still done manually in most maritime firms according to individual standards and guidelines. Formats that important files are exported in also differ widely.

Without high-quality, interoperable data, maritime players run their ships only as well as their own data reporting allows.

Two solutions arise: one, a standardised list of data points to report; two, seamless consolidation and analysis of data via platform integrations.

The proof-of-concept project established by OSM Maritime, Thome Group, and V.Ships is exploring the former, but the large variance in ship sizes and data reporting needs will likely invite significant friction.

Platform integrations, on the other hand, handle standardising quietly in the background. Time to familiarise with the software notwithstanding, they enable businesses to rapidly take in new insights and use them just as quickly.

Maritime connects the world, but the industry remains a mess of data islands. Recent supply chain shocks have finally brought its consequences to the fore.

There’s much maritime can - and should - do to bridge the gaps. Platform integrations are the low-hanging fruit firms can easily seize. Especially while startups like Greywing continue to prioritze these partnerships at no cost to the partners.

Still, even that comes with its own challenges. Maritime consists of many players who still share apprehensions over data sharing.

But integrations are necessary if firms across the value chain want to thrive in the future. They will lay the groundwork for proper data stewardship and offer a springboard for maritime to truly scale up. It’s still early days, and that also gives the industry a chance to carefully consider what sort of data it requires and how to use them - and avoid Big Tech’s mistakes.

Whether you’re a data provider looking to integrate your feeds into other platforms to make life easier for your customers, or you’re a maritime company looking for more detailed data to expedite data-driven decision-making, we’d love to hear from you on how we can make maritime even more efficient.

We release every week.

Learn about new tech in maritime, and what we've built as soon as it's live.